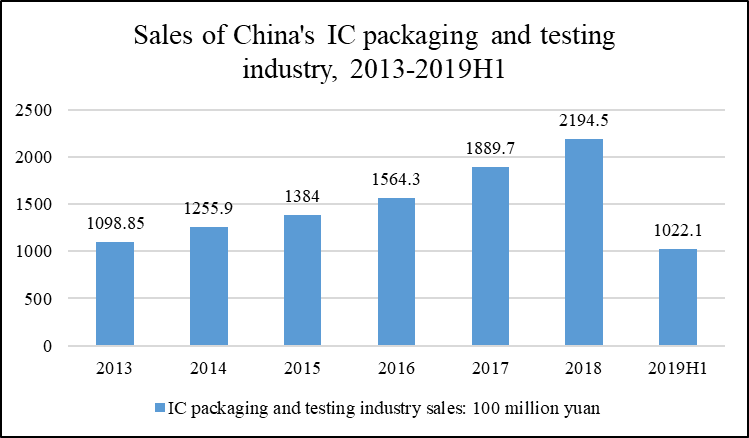

Abstract: China's IC industry has been flourishing in recent years, huge market demand together with government investments are the major driving forces for this development. The status and development momentum of the Chinese IC industry also attracted wide interest and attention of international counterparts. A group of domestic IC experts are invited by the JoMM to write a series of articles about China's IC industry, including the history, current status, development, and related government policies. Information in these articles is all from public data from recent years. The purpose of these articles is to enhance mutual understanding between the Chinese domestic IC industry and international IC ecosystem. The following article is the third one of this series, the status quo of China's IC industry. The IC industry chain is very long including design, manufacturing, special equipment, materials, packaging and testing. The article series are arranged in accordance with this scope.

Keywords: Packaging; Testing Industry